Money Basics Worksheets Results

Learning about budgets - Consumer Financial Protection Bureau

protect their money and property so they can meet future needs (such as emergency savings and insurance). ° Savings: Money you have set aside in a secure place, such as in a bank account, that you can use for future emergencies or to make specific purchases. ° Short-term goals: Goals that can take a short time, or up to five years, to reach ...

https://url.theworksheets.com/78iv82 Downloads

Preview and Download !

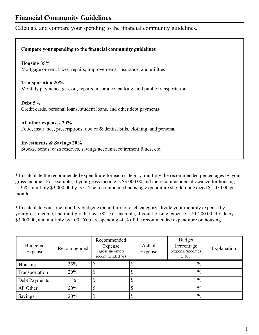

Personal Financial Workbook - Consumer Credit

of how you are spending your money. By using the worksheets you’ll be able to paint a clear picture of your ... and reuse the worksheets as needed. American Consumer Credit Counseling 130 Rumford Ave, Suite 202, Auburndale, MA 02466-1371 1-800-769-3571 ConsumerCredit.com. 1 Financial Community Guidelines

https://url.theworksheets.com/vej211 Downloads

Preview and Download !

Checking account basics - Consumer Financial Protection Bureau

On the other hand, a savings account is usually used to set money aside for mid- and longer-term financial goals. Some banks and credit unions limit the number of withdrawals you can make from your savings account each month. Money in savings accounts can sometimes collect interest. A checking account can be a useful tool for managing your money.

https://url.theworksheets.com/7rfj97 Downloads

Preview and Download !

Checking account basics - Consumer Financial Protection Bureau

Use the handout to answer the “Exploring the basics of opening a checking account” questions on the next page. As a class, participate in a banking simulation. Answer the reflection question. Banking scenario Imagine you’re just about to open a checking account. You’ve saved $500 to open the account.

https://url.theworksheets.com/7tft52 Downloads

Preview and Download !

Lesson 6: Savings and Investing 45 minutes - TD Bank

• Long-Term Savings Plan Worksheets (1 per student, 2-sided) • Calculators • 4 Corners cards printed out • 4 Corners statement pages printed ... Materials • Investing - when you purchase a security like a stock or bond, in the hopes that over time it will make money • Stocks - pieces of a public company owned by the general public ...

https://url.theworksheets.com/31wq64 Downloads

Preview and Download !

Everyday Math Skills Workbooks series - Home Math - The Mathematics Shed

• Money Math We have also developed a math skills booklet called Simply Math to help learners with different math operations that are needed for this series. Home Math has three sections. Each section has a variety of topics and worksheets and a review page. The workbook is designed so that you can work on your own or with others in your class.

https://url.theworksheets.com/4jo633 Downloads

Preview and Download !

MONEY MANAGEMENT FOR YOUNG ADULTS - myfinancialgoals.org

YOUR FINANCIAL LIFE – MONEY MANAGEMENT . FOR YOUNG ADULTS . This program will help you understand the financial . concepts you will need in order to effectively manage your money. We will cover the following topics: • Financial Planning • Banking on Your Future • Understanding Credit and Credit Reports • Learning about Earning

https://url.theworksheets.com/2lud86 Downloads

Preview and Download !

Credit – Lesson – What is Credit? - Hands on Banking

Credit is the ability to borrow money. There are lots of situations where people borrow money: car loans, credit cards, student loans, etc. In each case, you’re borrowing money from a lender with a promise to pay it back. The money you owe is called debt. Earning the trust and confidence of banks a nd other businesses to lend you money is call ed

https://url.theworksheets.com/6xc285 Downloads

Preview and Download !

Banking – Lesson – Checking Accounts

The Basics A checking account is a great tool for managing your money day-to-day. A checking account is a type of bank account that allows you to put money in—make a deposit —or take money out—make a withdrawal. A checking account allows you to pay for things in other ways than using cash—like writing checks or using a debit card.

https://url.theworksheets.com/3w9k79 Downloads

Preview and Download !

BASIC INVESTING - usalearning.gov

the more money you’ll have in the future. 1.PotentIal for hIgher returnS 2.achIevIng long term goalS Savings alone might not allow you to accumulate enough to reach your goals. Investing those same dollars can increase those chances, or at least position you to accumulate more money over time. 3.InflatIon Inlation affects goals that are years ...

https://url.theworksheets.com/6fhy111 Downloads

Preview and Download !

<< Previous results Next results >>