Accounting Worksheets Results

Accounting Worksheet Template

Using the Simple Accounting Worksheet we can easily record all the transactions happening in our business. Step 3 – Create Financial Statements You can use the information on your Simple Accounting Worksheet to create an Income Statement, Balance Sheet, and Cash Flow Statement, depending on your needs.

https://url.theworksheets.com/3nzx159 Downloads

Preview and Download !

Financial Accounting Workbook (Version 1.0) Tony Bell

Accountingworkbook.com is a website that offers accounting tutorial videos for dazed and confused accounting students all over the world, many of whom stumble on to the website late at night while cramming for exams. The following account balances relate to the company’s January 31, 2017 year-end financial statements:

https://url.theworksheets.com/bnj220 Downloads

Preview and Download !

UIL Accounting Worksheet - University Interscholastic League

UIL Accounting Worksheet: A Tool for Accrual and Deferral Adjusting Entries What WE Will Do in This Session: 1. Examine the most common complaint about Merchandise Inventory on the Worksheet 2. Modify the worksheet format to “Write Down What You Know” 3. Compare T-account format (vertical) to worksheet format (horizontal) 4.

https://url.theworksheets.com/6fwc135 Downloads

Preview and Download !

ACCOUNTING 101 - AccountEdge Knowledge Base

This document was written with the best intentions of describing the daily accounting functions that most small business owners grapple with. The accounting processes, terminology and theory described here relates to our own experiences here in the USA, and may not translate exactly to your own local, regional, or national customs, laws, or prac...

https://url.theworksheets.com/1r1g249 Downloads

Preview and Download !

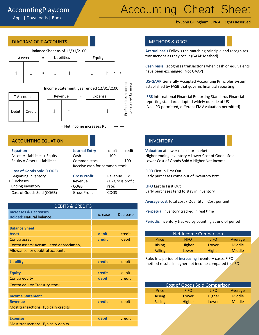

Accounting Cheat Sheet

Accounts receivable (AR) Cash due from customers who have purchased goods or received services not yet paid for Inventory Goods for sale or manufacture, valued under GAAP at lower of cost or market Prepaid expense Expenses paid in advance, considered an asset until used (such as a two year insurance policy)

https://url.theworksheets.com/3axo1066 Downloads

Preview and Download !

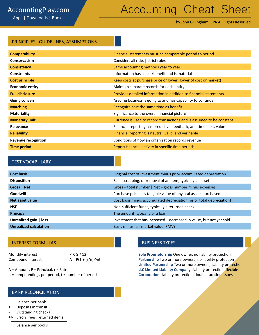

ACCOUNTING SCHOLAR.COM GENERAL ACCOUNTING CHEAT SHEET©

ACCOUNTING SCHOLAR.COM – GENERAL ACCOUNTING CHEAT SHEET© This sheet is not for unauthorized distribution. Table of Contents Balance Sheet & Assets, Liabilities & Shareholder’s Equity Forms of Business Organization (Page 4) Use of Financial Statements by Outsiders (Page 5) Simple Ledger (Page 6) Cash Control & Management (Page 7)

https://url.theworksheets.com/6fwg267 Downloads

Preview and Download !

Accounting Notes - Alamo Colleges District

Completing the Worksheet: Step 1: Step 2: Step 3: Step 4: Step 5: Step 6: List the accounts and enter their balances from the general ledger into the appropriate trial balance column (Dr or Cr). Total both columns.

https://url.theworksheets.com/2jkm341 Downloads

Preview and Download !

Accounting Skills Assessment Practice Exam Page 1 of 11

20. The general ledger account for Accounts Receivable shows a debit balance of $50,000. The Allowance for Doubtful Accounts has a credit balance of $1,000. If management estimates that 5% of Accounts Receivable will prove uncollectible, Bad Debts Expense would be recorded for $1,500. $2,540. $2,500. $3,500.

https://url.theworksheets.com/1v1j704 Downloads

Preview and Download !

Financial Accounting Workbook (Version 2.0) Tony Bell

confused accounting students all over the world, many of whom stumble on to the website late at night while cramming for exams. The following account balances relate to the company’s January 31, 2024 year-end financial statements: Utilities expense 1,500 Accounts payable 300 Depreciation expense 350 Common shares (February 1, 2023) 50 ...

https://url.theworksheets.com/32dt107 Downloads

Preview and Download !

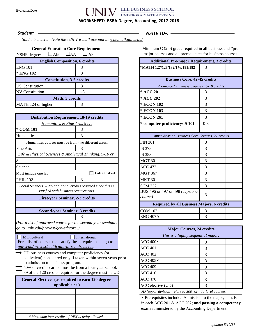

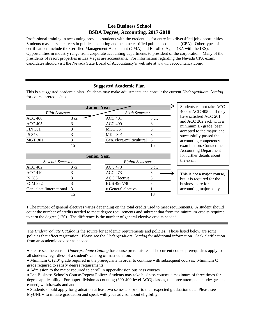

WORKSHEET: BSBA Degree, Accounting, 2017-2018 - University of Nevada ...

WORKSHEET: BSBA Degree, Accounting, 2017-2018 General Education Core Requirements Upper-division Business Core Courses, 27 credits English Composition, 6 credits Additional Pre-major Requirement, 3 credits Required by all Business Majors, 6 credits General Electives (as required to earn 120 degree-applicable cr.) Distribution Requirement, 18-19 ...

https://url.theworksheets.com/6fwj103 Downloads

Preview and Download !

Next results >>