Business Ownership Worksheets Results

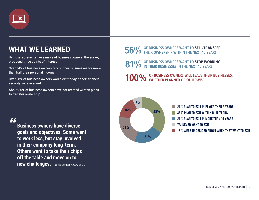

BUSINESS OWNER SURVEY REPORT - cdn.ymaws.com

Owners’ Expected Exit Paths An Exit Path is the route that an owner takes to successfully sell or transfer their business ownership, even if that owner plans to work forever. When asked about which Exit Path they were interested in, owners often chose more than one option. The results show that a third-party sale is still the most popular consideration, which lines up with trends from ...

https://url.theworksheets.com/5pul88 Downloads

Preview and Download !

Sample Business Valuation Report - ValuAdder

The business ownership seeks to obtain a business appraisal in order to offer the business for sale. The General Manager who has been with the business for the last 10 years plans to remain past the business sale. In addition, all of the skilled staff members have also expressed interest in continuing with the business past the ownership ...

https://url.theworksheets.com/4r1h428 Downloads

Preview and Download !

SWOT Analysis Worksheet - Practical Business Skills

to improve your business. Here are some examples of the types of questions to ask yourself while filling out the table, but don’t limit yourself to these questions. Strengths and weaknesses are internal factors that are directly related to your business. You affect your strengths or weaknesses by taking action.

https://url.theworksheets.com/6910109 Downloads

Preview and Download !

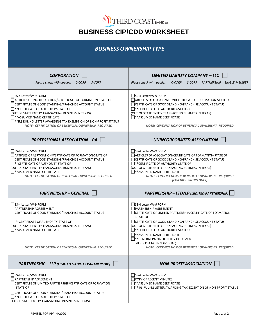

BUSINESS CIP/CDD WORKSHEET

BUSINESS CIP/CDD WORKSHEET . REVISED FOR PPP, 4/2020 Page . 1. of . 2. BUSINESS OWNERSHIP TYPE . CORPORATION . Please check with applies, C-CORP S-CORP . LIMITED LIABILITY COMPANY – LLC . Please check with applies, C-CORP S-CORP PARTNERSHIP SINGLE-MEMBER. SS-4 Letter/W-9 FORM SS-4 Letter/W-9 FORM

https://url.theworksheets.com/7nt170 Downloads

Preview and Download !

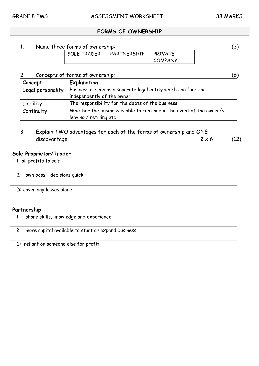

FORMS OF OWNERSHIP - EMS Class

Business is taxed at company tax rate on profits of the business Management of business Owner or can employ manager Partner/s or can employ manager Directors are involved in management of business 5. Match the words/ concept in Column A to the correct form of ownership in Column B. Column A Column B 5.1 Partners A Private Company

https://url.theworksheets.com/7o8151 Downloads

Preview and Download !

FORMS OF OWNERSHIP - EMS Class

of business 5. Match the words/ concept in Column A to the correct form of ownership in Column B. Column A Column B 5.1 Partners A Private Company 5.2 Limited liability B Sole Trader 5.3 No document required for formation C Partnership Answer: (write the correct letter only) 5.1 _____ (1)

https://url.theworksheets.com/6f9776 Downloads

Preview and Download !

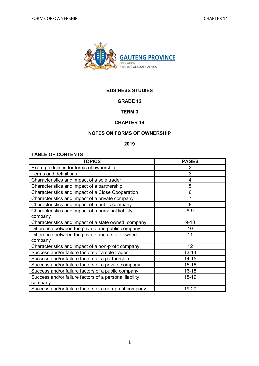

BUSINESS STUDIES GRADE 12 TERM 3 CHAPTER 14 TABLE OF CONTENTS

Form of ownership The legal position of the business and the way it is owned. Continuity Continue to exist even if a change of ownership takes place, e.g a member or shareholder dies or retires. Surety If a person or business accepts liability for the debt of another person or business. Securities Shares and bonds issued by a company.

https://url.theworksheets.com/6f98239 Downloads

Preview and Download !

Business Income Worksheets: Simplified!

factor. It is necessary to take the annual business income basis on page four and apply the estimated recovery period as a percentage of a year. Since six months equals 50%, then select 50% of your annual business income basis and add the extra expenses to determine the total business income and extra expense policy limits.

https://url.theworksheets.com/40j5135 Downloads

Preview and Download !

<< Previous results Next results >>